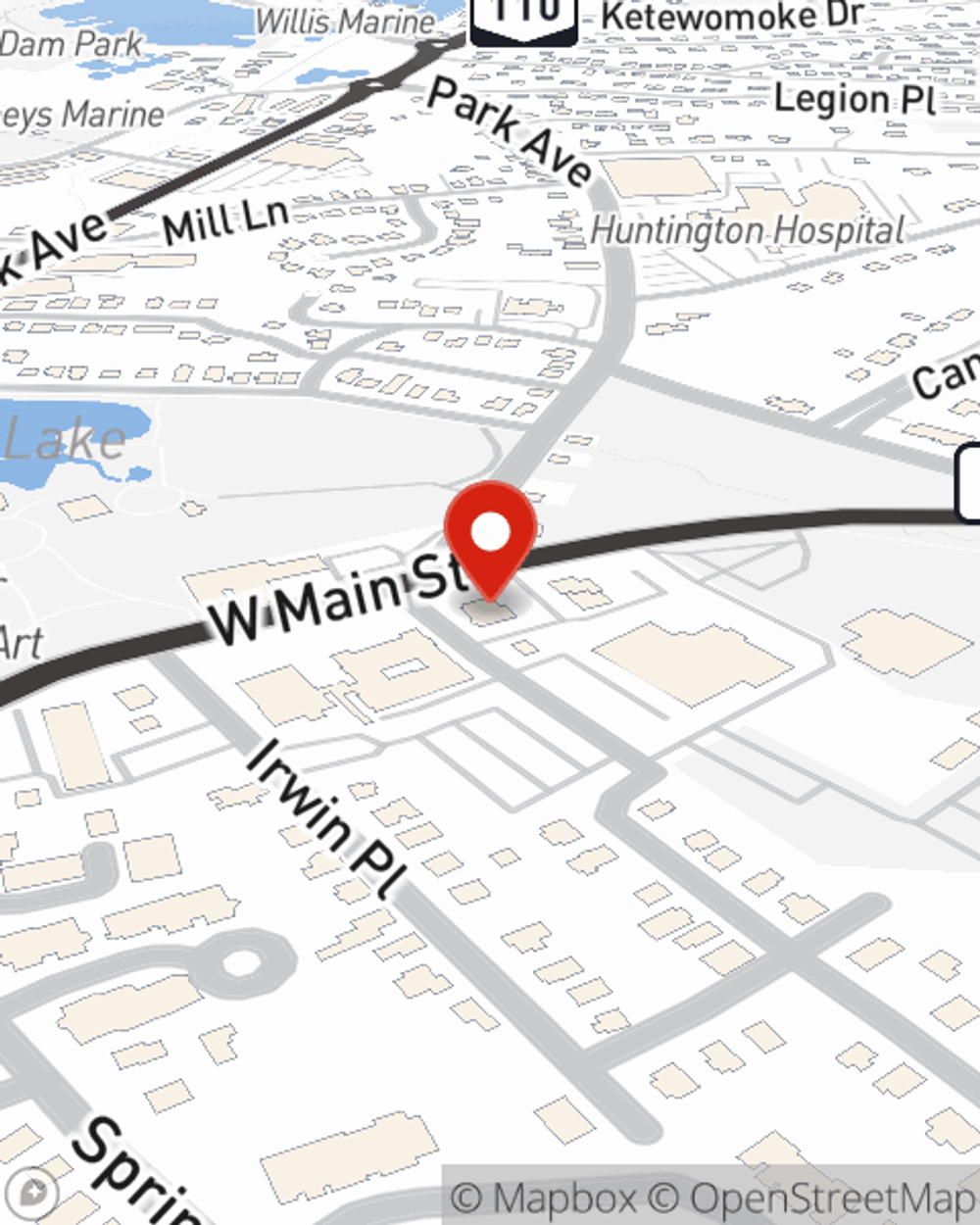

Life Insurance in and around Huntington

State Farm can help insure you and your loved ones

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

- Huntington

- Halesite

- Lloyd Harbor

- Cold Spring Harbor

- Long Island

- New York

- Suffolk County

- Nassau County

- Syracuse

- Buffalo

- Albany

- Binghamton

- Manhattan

- Holbrook

- Melville, NY

- Huntington Station

- Syosset

- Northport

- Woodbury

- East Northport

- Smithtown

- Kings Park

- Dix Hills

- Oswego

It's Never Too Soon For Life Insurance

State Farm understands your desire to protect the ones you hold dear after you pass away. That's why we offer terrific Life insurance coverage options and empathetic reliable service to help you opt for a policy that fits your needs.

State Farm can help insure you and your loved ones

Life won't wait. Neither should you.

Put Those Worries To Rest

Personalized service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If tragedy strikes, Joe Mattera stands ready to help process the death benefit with care and consideration. State Farm has you and your loved ones covered.

To check out State Farm's Life insurance options, visit Joe Mattera's office today!

Have More Questions About Life Insurance?

Call Joe at (631) 683-5400 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

Life insurance basics

Life insurance basics

Understanding life insurance, what it is, how it works and the different types can help you decide which life insurance policy is right for you.

Joe Mattera

State Farm® Insurance AgentSimple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

Life insurance basics

Life insurance basics

Understanding life insurance, what it is, how it works and the different types can help you decide which life insurance policy is right for you.